While everyone is talking about the paperless office and “Green IT” initiatives, it is a known fact that print isn’t going to die… at least not anytime soon. Channel Post speaks to industry experts to find out why and how?

When it comes to the print industry, there’s always a question that needs answering – “Is the future of ‘print’ grim or bright?” There of course are factors that are affecting the growth of the printer business.

These include the trends in consumer spending, the state of the global economy, new technologies and the speed of change, changing customer expectations, globalisation and environmental concerns.

Industry experts we spoke to do realise the impact “digital” is having on the traditional printer business. Having said that though, the printer industry isn’t going anywhere.

The Middle East Scenario

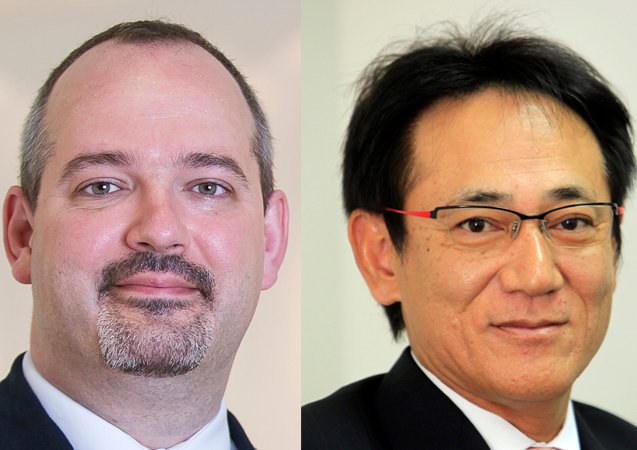

“The printer market in the MEA region continues to grow and remains very vibrant across key industry segments such as SMB, government and enterprise,” explains Soichi Murakami, the Managing Director at Brother International (Gulf). “Brother Gulf is seeing double digit growth with the laser category of multifunction printers, along with the stand alone segment. This is mainly attributed to the introduction of faster and feature rich models that are promoted extensively with aggressive prices.”

Dan Smith, the Head of Integrated Marketing for the Middle East and Africa region at Xerox is also of the opinion that the pronouncements of the early nineties relating to the paperless office and their link to the death of printing have not really become a reality. “Whilst it is true that different methods of presenting, sorting and using data have become commonplace, the volume of printed material is still growing in the Middle East and Africa. In fact, shipments of printers are predicted to grow 6-8% according to IDC over the next two years and PIRA predicts that total printing revenues in the Middle East and North Africa (MENA) are forecast to grow 7.2% per annum reaching $26 billion by 2018,” he adds.

Demand Generation

Colour is a major push for the printer industry, says Smith. According to him, trends being seen are the simple but continuing adoption of colour printing in the office and the need to control costs of that offer. “In the SOHO sector meanwhile, further adoption of multifunction devices is happening at the cost of single function,” Smith adds. “These devices now come configured with Wi-Fi and the ability to print from smartphones and tablets, whilst offering competitive costs. There will however always be a place for single function and recent trends show that the MFP tipping point is slowing.”

Murakami meanwhile says that according to various market research agencies, the demand for standalone printers would be flat for the next three to four years and then begin to decline. “With MFPs costing only marginally more than standalone printers, organisations are finding that MFPs are an attractive option. These devices offer scanning, copying, faxing and printing at the same workstation, improving productivity and efficiency at every level. MFPs have begun to enjoy double digit growth in all markets and the current trends appear to follow this forecast,” explains Murakami.

Though the demand of printers seem to be increasing, where is the demand coming in from? “Office and commercial sectors are two distinct markets for print and both are evolving as well as growing,” says Smith. “Trends affecting office printing are mostly about mobility and ease for users of accessing data and print facilities as well as Managed Print Services.”

According to Smith, the overall organisational behaviour is driven by what the end users need. He also adds that vendors are now reacting to this, by bringing in a wide portfolio of print/document management hardware and software and related services.

“There has been a substantial increase in the demand for colour inkjet MFCs from small offices and from homes. The demand can be attributed to the very attractive low purchase prices and lower print cost per page. Meanwhile, the demand for mono laser and colour laser devices is expected to flourish in the SMB, enterprise and government segments,” adds Murakami.

Margins for the Channel

With so much happening within the printer industry, is there enough margin for the chanel? “Margins have dwindled over time, especially in the colour inkjet and entry level mono laser printing devices,” asserts Murakami. “However, the total business continues to show margins that are still adequate to drive sales and innovation. Manufacturers have had to dig deep to bring down cost of manufacturing to be able to sustain margins at the dealer level. In some cases, this has been possible by establishing new factories in countries such as Vietnam and the Philippines with more competitive labour costs.”

Smith adds that In terms of partner profitability, Xerox ensures that all software, hardware and services capabilities are available to channel partners. “A good example of this is the Xerox Personalised Application Builder which along with an SDK allows partners and channels to create specific solutions for their customers. This value add allows for enhanced profit opportunities as well as better ‘stickiness’ with customers which again allows for superior returns,” he claims.

Having said that however, some industries have already had a shift in their workflow from hard copy to electronic format due to regulatory pressures. Has that affected the printer market in general? “Of course there has been a shift in certain areas not just driven by regulatory but also consumer demand. One obvious trend is e-presentment of bills and statements in banking, utility and telephony,” says Smith. “This is good for users and good for vendors and providers and great for the environment.”

According to Smith, there may be impacts to the type of business being done. “However, the market for MFPs and printers remains healthy across the region. The key is further opportunities and new business rather than focusing on what has gone. Trends such as MPS is allowing resellers new revenue and profit streams,” says Smith.

Murakami meanwhile says that the dogma today is ‘To print only if you must!’. “In the early days, print volumes were growing exponentially year-on-year. This is attributed to several factors, one of which is that organisations were growing rapidly and led to growing print volumes as well. Other factors were due to finding new ways to do things differently that would improve response times to internal and external customers. We do not expect this to have a major impact on the printer / MFP markets,” concludes Murakami.