The worldwide total addressable IT market is forecast to grow 3.5% to reach US$4.7 trillion this year despite cautious spending due to ongoing economic issues, according to new research from industry analysts at Canalys. Partner-delivered IT technologies and services will exceed US$3.4 trillion in 2023, accounting for more than 70% of the global total addressable IT market.

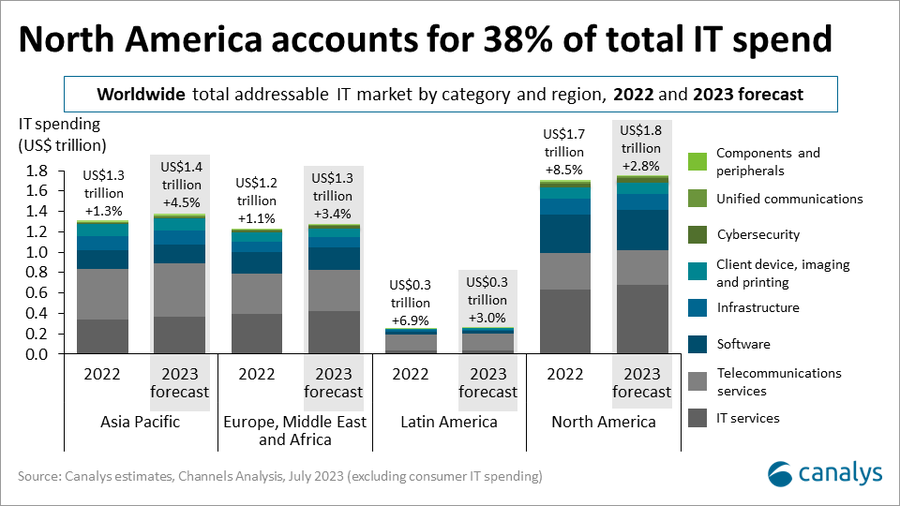

Spending in North America will grow 2.8% this year, down from 8.5% in 2022, to account for 37.7% of the total addressable market. The slowdown in cloud service provider capital expenditure in the first half of the year and a decline in telecommunications services spending are key factors. Asia Pacific is forecast to grow 4.5%, EMEA 3.4% and Latin America 3.0% in 2023.

“The long-term technology mega-trends will continue to drive growth opportunities for both vendors and channel partners in 2023,” said Matthew Ball, Chief Analyst at Canalys. “Digital transformation, cybersecurity, compliance, sustainability and the emergence of generative AI will underpin IT services engagement, the adoption of new software and infrastructure refresh. But there are still major headwinds for the industry to navigate. The threat of recession, rising interest rates, high inflation, trade disputes and extreme weather events will continue to cause much disruption and affect confidence.”

The latest research shows cybersecurity will remain a key growth opportunity, increasing by 11.1% to US$79 billion. This reflects the heightened demand for securing data, systems and people against rising threats. Network infrastructure will reach record highs, as fulfillment of campus switch and Wi-Fi 6/6e access point order backlogs boost spending by 13.9% to US$72 billion. Price rises, renewals and the upselling of subscriptions will grow cloud application software spending by 19.3% to US$215 billion. Optimization of public cloud spending, cybersecurity posture transformation and business adoption of generative AI will create further consulting opportunities and contribute to IT services spending expanding by 7.5% to US$1.5 trillion. Managed IT services alone will become a half-trillion-dollar business.

On the other hand, sales of servers, storage and client devices are expected to suffer negative or flat growth after the strong demand surge fueled by accelerated data center buildout by cloud service providers and enablement of remote workers during the COVID-19 pandemic. But AI servers will be a bright point.

Canalys reveals that partner-delivered IT technologies and services will reach US$3.4 trillion in 2023, which will account for more than 70% of the total. Overall, IT spending via partners will grow 3.7%, outpacing direct spending between customers and vendors. “There’s an exciting future ahead for this industry,” added Ball.

“We’re looking at a sector that will nearly double in size over the next decade, and an ecosystem of hundreds of thousands of vendors and millions of channel partners. Given the importance of the channel, the success of vendors will increasingly rely on their resell, co-sell, co-marketing, co-retention, co-development and co-innovation strategies.”

Despite economic concerns leading to greater scrutiny of IT spending in the first half of 2023, there are early signs of improving demand and a gradual easing of budgetary constraints for the second half. The industry’s growth is expected to rebound next year, fueled by businesses and governments worldwide accelerating their investment in technology refresh, pushing ahead with delayed projects and new initiatives. Initial forecasts for 2024 expect more robust growth of 6.9% overall, with IT spending hitting US$5.0 trillion for the first time.

“Delving deeper into these numbers is vital for industry leaders and decision-makers to understand the implications for their businesses and gain a greater understanding of their total addressable, serviceable available and serviceable obtainable markets,” added Ball. “This comprehensive understanding of the market dynamics is core to our approach at Canalys.”